In the third quarter of 2023, the Vietnamese industrial real estate market continued to witness strong growth, becoming a “highlight” on the real estate map. According to a report by the Vietnam Real Estate Brokers Association (VARS), the market is sending positive signals with an increase in supply, transaction rates, and rental demand.

Increase in Supply and Absorption Rates

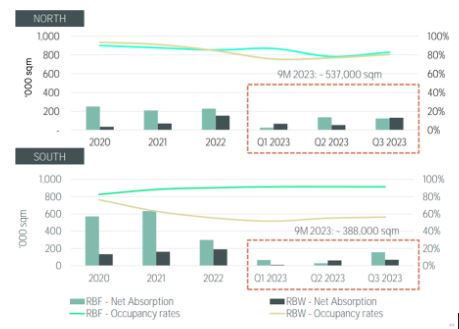

The market recorded significant growth with high industrial zone occupancy rates ranging from 85% to 90% in both the Northern and Southern regions.

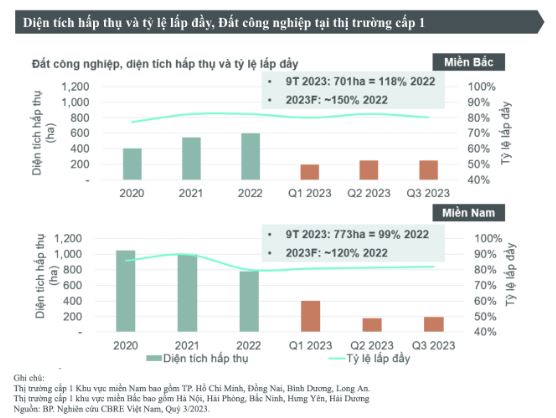

Specifically, the Southern and Northern markets respectively recorded 450,000m2 and 752,000m2 of new warehouses and factories becoming operational in the first nine months of the year. Overall, the absorption rate reached over 700 hectares in nine months, an 18% increase compared to the whole year of 2022.

The industrial land absorption rate in 2023 reached a record high, increasing by more than 50% compared to the same period last year in the Northern region and by more than 20% in the Southern region. Specifically, in the South, the industrial land absorption rate in Q3 reached over 190 hectares, a 5.9% increase compared to the previous quarter, and over 770 hectares by the end of Q3 2023, which is 20% higher than the entire year of 2022. In the North, the industrial land absorption rate in Q3 2023 in the primary markets reached 251 hectares, 18% higher than the absorption rate for the entire year of 2022.

Strong Demand from Key Industries

The Northern region continued to attract interest from industries such as electronics, chemicals, mechanics, and rubber. Large corporations like Fulian Precision Technology, Foxconn, and Goertek chose industrial zones in Bac Giang and Bac Ninh for their manufacturing plants. Meanwhile, the Southern region saw more diverse demand, with participation from industries ranging from automobile manufacturing and electronic components to packaging and garment, like Far Eastern, Cheng Loong, Nitto Denko, Yuwa.

Increase in Industrial Land Rental Prices Due to Favorable Demand

Another important factor is the continued rise in industrial land rental prices, reflecting strong market demand. The transaction rate for industrial land increased by about 5.9% compared to the previous quarter, with the first nine months of 2023 being 20% higher than the entire year of 2022.

Bright Future Thanks to Main Drivers

Experts from Savills Vietnam believe that the future of Vietnam’s industrial real estate will continue to be bright due to a young and dynamic workforce, competitive labor costs, an export-oriented economy, a stable business environment, a strategic geographical location, and Vietnam’s active participation in Free Trade Agreements.

Moreover, Vietnam upgrading its cooperation to a comprehensive strategic level with major partners like the United States, South Korea, and China will help investment flows from these countries continue to “pour strongly” into the Vietnamese market. Experts also predict that foreign investors will prioritize eco-industrial zones, urban-service industrial zones, smart industrial zones, and integrated logistics in the future.

Conclusion Overall, the Vietnamese industrial real estate market in Q3 2023 has been and is on the path of strong development, promising a bright future with support from various policy, economic, and political factors from the Government.

Source: Tuổi Trẻ Newspaper, CBRE